The Intelligent Agency: How artificial intelligence can transform the industry

Artificial intelligence (AI) has already reshaped everyday life for many of us. We ask the virtual assistants in our smartphones and smart speakers to give us weather reports, play music, shop, and more. This technology is just starting to make inroads into the insurance world.

AI-powered technologies like natural language processing, machine learning, and predictive analytics will bring about dramatic changes in user experiences and solution possibilities that wouldn’t be conceivable otherwise. The applications won’t just provide easy access to information; they’ll also present recommendations, offer predictions, and reveal trends that can guide day-to-day operations. They’ll even speak and understand insurance jargon.

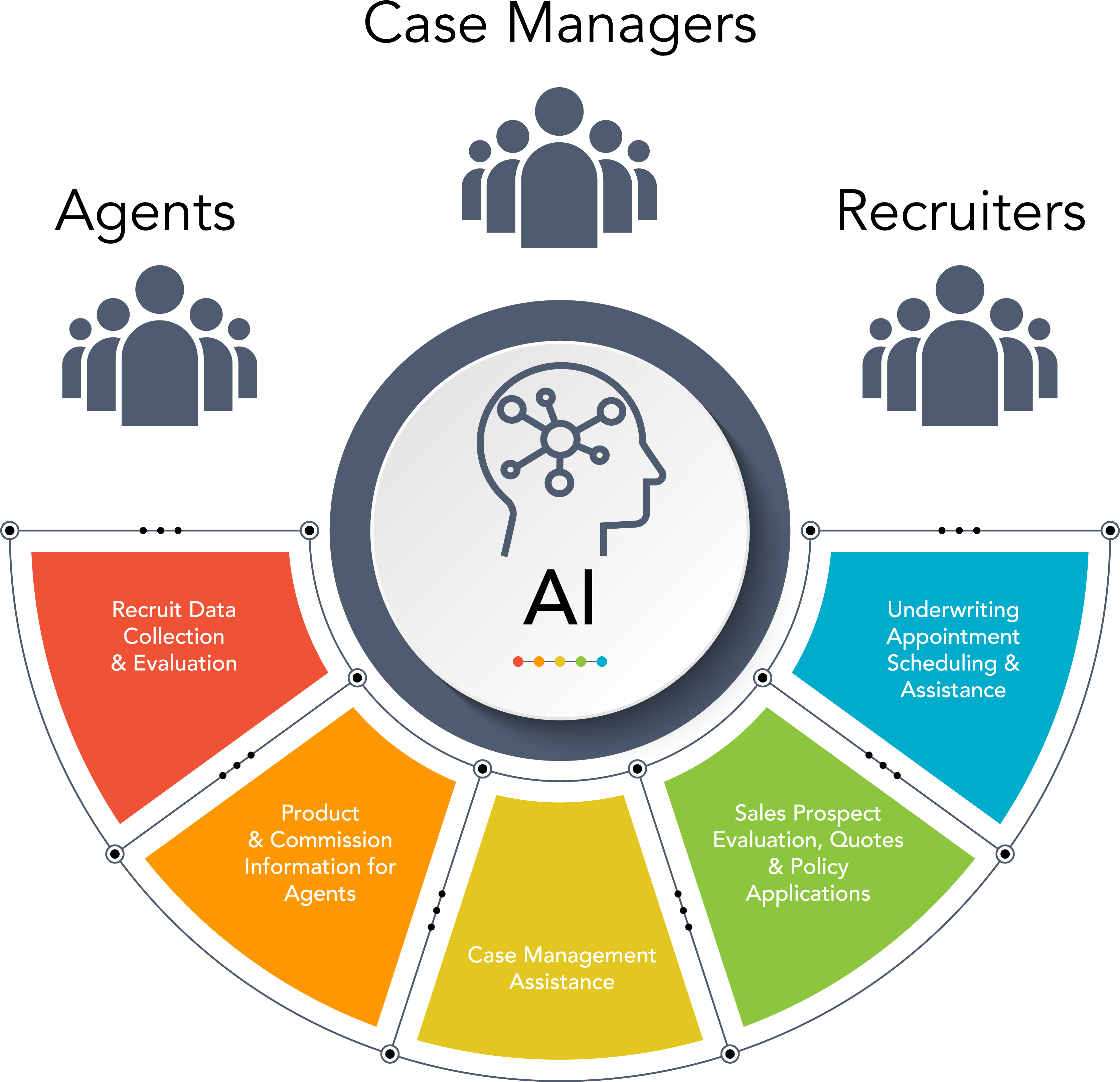

Insurance technology is already being tested that will leverage AI to help agencies bolster their value to agents, streamline case management processes, and more. Some example scenarios that reveal AI’s promise are:

Agent Recruiting and Support

- First contact: A potential recruit is sizing up your agency. The agent visits your advisor portal and is greeted by a virtual assistant. Through chat or voice, the agent asks some basic questions about your business and receives answers instantly. The assistant then offers to direct the agent to a recruiter and enters the agent’s information into the agency’s recruitment system.

- Candidate evaluation: After receiving data about multiple candidates, the recruiter runs the data through a predictive analytics system. The AI in this system uses the submitted data cross-referenced with public industry and general research datasets to predict the candidate’s production potential in terms of application premiums. The recruiter can now focus recruitment efforts on the most desirable candidates.

- Agent support: An agent who has an established relationship with the agency needs product information and has commission payout question. Instead of trading emails or playing phone tag with the recruiter, the agent asks the agency’s virtual assistant, which answers most of the questions. For those questions it can’t answer, the assistant helps schedule a call with the recruiter.

Smart Sales Tools

- Sizing up prospects: An agent has a list of leads but needs a fast, logical way to prioritize them. The agent turns to the predictive analytics system to quickly pull up a report showing the potential annual premium for each lead based on available data and recent trends. The agent narrows the list for prospects with predicted annual premium above a certain amount.

- Quotes and comparisons: An agent is on a call with a client and needs a quick product quote or comparison. The agent accesses a virtual assistant, provides all the relevant details for the quoting engine, and within seconds, receives a quote.

- Cross-sell/upsell suggestions: During the presale process, the agency management system analyzes a clients’ data and sees an opportunity to sell long-term care insurance. The system then sends its recommendations as an alert to the agent for follow-up.

- Faster applications: When a client is ready to apply for a policy, the agent accesses the virtual assistant, provides required application data and instantly it feeds the data into the drop-ticket system for the agent.

Case Management and Underwriting

- Status updates: Instead of fielding calls and emails from agents about the progress of cases, case managers leave that work to a virtual assistant. An agent accesses the agency portal, asks the virtual assistant for an update and receives an answer instantly. The assistant even offers the option to escalate to a case manager.

- Technical assistance: An experienced case manager has left the agency, and the replacement is still learning the agency management system. The new case manager forgets how to update a requirement and asks a built-in virtual assistant. The assistant explains where to find that feature and provides a link to more help.

- Scheduling: A case manager needs to arrange a medical exam for an applicant. The manager asks the virtual assistant to find an available time with a service provider that falls within the applicant’s preferred timeframe. The assistant finds an appointment and does the scheduling.

A Promising Future

The march of technology continues for the insurance industry, and AI looks likely to be the next big leap. It’s not too early to start thinking about how these technologies can help attract agents and introduce efficiencies into business processes.

About the Authors

Shashank Joshi, Director of IT, leads the technology innovations lab at Ebix Inc., with a focus on Artificial Intelligence, Machine Learning and Robotics Automation. His expertise includes Case Management Operations, E-Applications, and Underwriting Workbench products. He can be reached at Shashank.Joshi@ebix.com.

Bryan Eshelbrenner is director of product management for Ebix’s SmartOffice platform. He has more than 16 years of experience in the financial technology sector, overseeing software design, development, quality control, sales, and marketing. He can be reached at Bryan.eshelbrenner@ebix.com.

Shashank Joshi